The future of blockchain depends on Mining Infrastructure Crypto because digital networks cannot function without the physical systems that secure them. Over the last decade, crypto has moved far beyond price speculation. What once looked like an experimental technology is now evolving into financial and settlement infrastructure. At the core of this evolution sits Mining Infrastructure Crypto, the physical and operational layer that keeps decentralized systems running every second of the day.

When people talk about crypto, they often focus on price charts, token launches, or trading volumes. The primary components of blockchain technology include hardware, energy, cooling systems, and data centres. Without these components, there is no way to settle a transaction or create a block, and therefore, no digital scarcity occurs.

Digital Assets Are Infrastructure, Not Trend

Over time, Blockchain digital assets have shifted from being seen as speculative bets to becoming part of the global financial architecture. According to reports from the Bank for International Settlements and multiple institutional research desks, digital assets are increasingly viewed as parallel systems for settlement and value transfer.

Today, digital assets represent:

• Settlement networks for cross-border transfers

• Decentralized monetary systems independent of central banks

• Smart contract ecosystems powering decentralized applications

• Institutional treasury reserves in selected cases

Bitcoin has now been added to the balance sheets of many large asset managers and public companies. This system is not supported by speculation, but rather by an established infrastructure that is currently in place.

At the center of this ecosystem is mining. Mining is not optional. It is the security engine that validates, confirms, and protects decentralized networks. Without it, blockchains stop functioning.

As adoption increases, network security must scale accordingly. That security is delivered through Bitcoin mining infrastructure, not through marketing campaigns or token narratives.

Mining Infrastructure Crypto: The Security Backbone

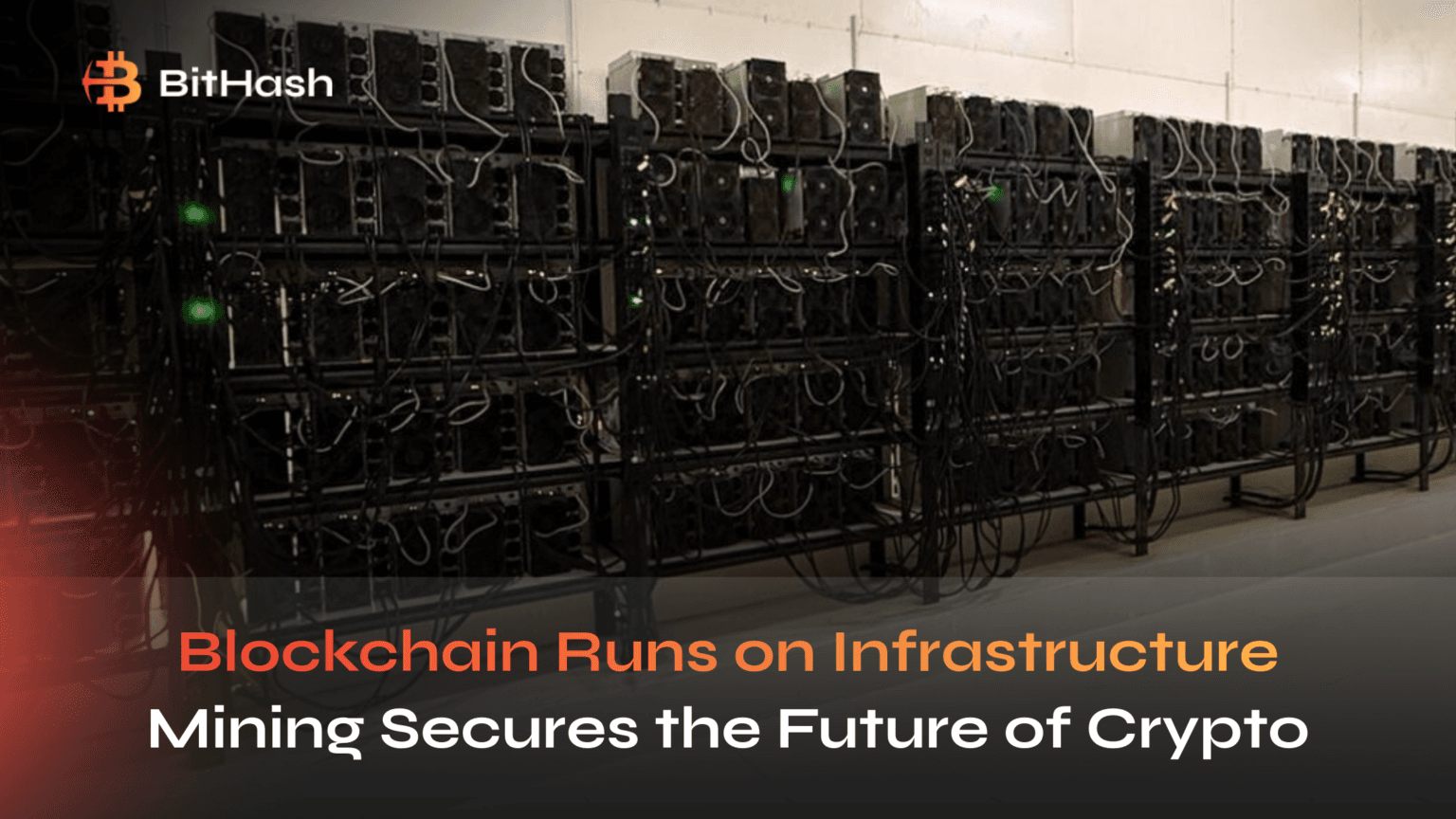

Mining Infrastructure Crypto refers to the physical and operational systems that power proof-of-work blockchains. The use of ASIC hardware, cooling architecture, energy sourcing, data center management, and a network connection ensures that Bitcoin can be verified through the proof-of-work mechanism – this is a system whereby a lot of computer resources are required to confirm that a transaction occurred so that fraudulent activity, such as double-spending, cannot happen on the network.

Miners perform four essential functions:

• Validate transactions

• Secure network integrity

• Prevent double-spending

• Maintain decentralization

Miners compete every 10 minutes to solve a cryptographic puzzle, and the winner adds a new block to the blockchain and receives a specified reward. This whole process also causes digital scarcity and implements the economic rules without the need for a central authority.

As the hash rate increases, the network becomes more secure. According to data from sources such as the Cambridge Centre for Alternative Finance, Bitcoin’s total hash rate has consistently set new records. That growth reflects increasing investment in infrastructure.

Without mining, blockchain ceases to function. The ledger would freeze. The system would collapse. That reality makes infrastructure the true backbone of crypto.

Digital Assets as a Hedge and Portfolio Diversifier

Institutional investors increasingly view digital assets through a macroeconomic lens. Bitcoin is often described as a store of value, sometimes compared to digital gold. At the same time, tokenization is expanding into real-world assets, securities, and commodities.

In this context, mining offers something different from simply buying coins on an exchange.

Mining provides exposure to Digital asset production, not just price movement.

That distinction matters.

Investors who buy Bitcoin on the open market take on the risk of price fluctuations. When they invest in a mining operation, they have exposure to production economics, the costs of energy used to produce Bitcoin, and operational efficiencies.

This creates:

• Hard asset exposure backed by physical infrastructure

• Energy-backed digital commodity production

• Potential upside during bullish cycles

Some funds now include Institutional crypto infrastructure as part of their alternative investments. Instead of buying and selling tokens, these funds are used to fund facility construction, purchase hardware, and pay for energy agreements.

This change in thinking shows that we are beginning to understand that digital assets are more than just financial instruments; they are also products created through industrial processes.

The Professionalization of Bitcoin mining infrastructure

The mining sector today looks very different from its early years. In the beginning, individuals ran small setups in garages or spare rooms. Now, operations span megawatt-scale facilities comparable to traditional data centers.

Modern Bitcoin mining infrastructure includes:

• MW-scale industrial data centers

• Hydro and immersion cooling systems

• AI-assisted fleet management software

• Long-term power purchase agreements

Cost per kilowatt-hour, hardware efficiency, uptime, and cooling are four important metrics to monitor for professional operators, as margins are tight and competitive globally.

As in the early internet period, data centers with internet sites were hosted in people’s homes, but data center providers began building their own data centers, providing long-term value after the investment. The evolution of the Mining Infrastructure Crypto model is unfolding in a similar way.

When an operator controls the infrastructure, they can control margins.

Why Infrastructure Dominates the Next Phase

- Scalable facilities increase production efficiency

• Advanced cooling protects hardware lifespan

• Long-term power contracts stabilize costs

• AI monitoring reduces downtime

• Infrastructure ownership strengthens long-term returns

These factors determine whether mining remains profitable during both bullish and bearish cycles.

Chart: Retail Era vs Infrastructure Era

Aspect | Early Retail Model | Infrastructure Model

Scale | Small setups | MW-scale data centers

Cooling | Air cooled | Hydro & immersion

Capital | Individual investors | Funds & institutions

Strategy | Short-term gains | Long-term accumulation

Risk Focus | Price volatility | Cost efficiency & uptime

This shift shows why infrastructure is becoming central to the economics of digital assets.

Strategic Location and the UAE Factor

Mining performance is greatly affected by where resources are located. Factors including access to energy, both on- and off-grid, as well as the clarity of relevant laws and regulations, will all influence operational profitability.

Energy reliability in the UAE and the wider Middle Eastern Gulf region is highly appealing to global miners seeking to enter markets that will deliver operationally efficient results. Therefore, inquiries about crypto mining investments in the UAE are continuing to rise among these global firms.

Mining in politically stable jurisdictions reduces operational uncertainty. When investors allocate capital to large facilities, they prefer predictable environments.

Energy-backed digital production requires reliable power. Without that, efficiency drops and margins disappear.

The UAE has positioned itself as a technology-forward region, which supports the growth of infrastructure-based industries, including digital assets.

Proof-of-Work and the Energy Debate

Many critics voice concerns about energy use. Nevertheless, multiple studies have shown that energy used for mining has increasingly incorporated renewable and surplus energy into the process.

The Proof-of-work security model combines digital scarcity and energy usage, which is why Bitcoin is inherently resistant to attack. The energy is not wasted. It is used to secure a monetary system.

In many regions, mining operations utilize stranded or excess power that would otherwise go unused. In that sense, mining converts surplus energy into scarce digital assets.

This is why mining should be viewed as industrial production rather than speculative activity.

Mining Infrastructure as a Long-Term Asset Class

Increasing digital adoption makes infrastructure increasingly valuable.

When considering incorporating blockchain into their operations, financial institutions will weigh the security of their settlement systems and the network’s reliability. Both of these depend on mining power.

Institutional investors now analyze mines alongside data centers and power plants with regard to uptime, cooling systems, and cost per transaction.

The use of digital currencies by institutions has matured from being a research topic to being an option for investing in family offices and private equity.

By converting electrical energy to cryptographic security, mining creates security that can be tracked, measured, and verified in a more professional manner.

Infrastructure vs Speculation

It is easy to confuse crypto with trading. But infrastructure operates on a different timeline.

Speculators react to short-term price swings. Infrastructure investors focus on years, not weeks.

Economic considerations for the production of digital assets include production costs, energy agreements, hardware lifespan, and network difficulty adjustment systems.

Digital asset production is increasingly aligned with commodity-style industries rather than speculative-trading firms.

Conclusion

The future of blockchain depends on Mining Infrastructure Crypto, as digital scarcity cannot exist without physical systems to secure it. Blockchain digital assets are no longer a trend. They are emerging financial rails, settlement systems, and reserve instruments. Mining remains the backbone of this ecosystem. It validates transactions, enforces rules, and converts energy into verifiable scarcity.

Those who understand Bitcoin mining infrastructure recognize that the opportunity lies not in hype cycles, but in long-term operational strength. As institutional capital continues flowing into Digital asset production, infrastructure ownership becomes increasingly strategic. In the end, crypto is not just code. It is hardware, energy, and operational discipline working together to secure decentralized finance.